Licensed Money Lender in Yishun | Trusted Singapore Loan Company

Established

Secure

Confidential

A legal money lender with a personal touch

How Are We Different from Other Licensed Private Money Lenders in Singapore?

Our aim as a licensed private money lender in Singapore is not just to help you with your immediate cash needs. We want to use our authorised money lender knowledge and experience to help you become debt-free as soon as possible.

We are a legal money lender who offers flexible repayment plans with customisable payment due dates, so you can adjust your payments to a timeline that works best for you.

As a trusted money lender in Singapore, our online loan applications are available round-the-clock at the convenience of your phone, tablet, or laptop. All our money lender loans also have fast approval processes, even for customers with a bad credit history. We are a reliable money lender that does not judge and discriminate. That’s why our customers love us!

To learn more about our loan company in Singapore, visit this page.

Licensed Money Lender in Yishun Providing Legal Loans at Your Convenience

R2D Credit is nestled in the Northern region of Singapore. We’re a licensed money lender in Yishun that’s easily accessible from any part of Singapore with many major bus services. In fact, we’re a money lender located only a one-minute walk away from Yishun MRT.

We’re also an authorised money lender with online loan applications available at any time of the day. We value your time and want to provide you with utmost convenience. Therefore, we’ve made our legal money lender loan application forms ultra simple!

To make things even more fuss-free and secure, we’re among the few local money lenders who offer Singpass Myinfo applications too.

As a licensed loan company in Singapore, we strive to offer all our customers a speedy approval process when they’re borrowing from a licensed money lender. This enables them to get the cash they need for any kind of financial situation.

CONTACT US TODAY

Top Highest-Reviewed Licensed Money Lender in Yishun

Established in 2009

6258 borrowers to date

S$74,812,870+ loaned

Certified in the Prevention of Money Laundering and Financing of Terrorism,

Money Lender Operations & Compliance Training (By Credit Association of Singapore)

Looking Into the R2D Credit Office

Types of Money Lender Loans Offered by R2D Credit

Our Simple Money Lender Loan Application Process

Our money lender loan application process takes just three quick steps to complete.

Step 1: Submit your money lender loan application

Fill out the money lender loan enquiry form online anytime. We’re a legal money lender in Singapore that offers online loan applications 24/7. Our loan officer will contact you and schedule an in-person appointment with you at our office.

Step 2: Visit our authorised money lender office for verification

At our registered money lender office, we will conduct a quick interview and credit history check to confirm your application. Remember to bring all the supporting documents for your loan along.

Step 3: Check the loan offer and receive your funds

Our loan officer will explain the money lender loan contract and ensure you understand every term of the contract. Once you’re agreeable, proceed to sign the loan contract. We’ll then disburse the funds to you via cash or PayNow.

Our Licensed Money Lender Interest Rates and Fees

Our loan company’s interest rates are capped at 4% per month.

Borrowers who are unable to repay their money lender loans on time may incur other fees as well. We charge a maximum of 4% interest per month for late payments (only on amounts overdue, not the entire outstanding amount). Additionally, we charge late fees capped at S$60 per month of late repayment.

Our processing fees for legal money lender loans range between 8-10% of the principal amount.

Rest assured, we are committed to ethical lending practices and will never charge more than 10% for your loan’s processing fee. We prioritise your financial well-being and strive to offer clear, upfront terms without any hidden charges or surprises.

Frequently Asked Questions

Is it safe to borrow from licensed money lenders in Singapore?

Absolutely, but it is essential that you verify that the lender is fully licensed and authorised before proceeding with the loan.

To better understand how legal money lenders operate, read our articles on debunking myths about licensed lenders and money lender scams in Singapore.

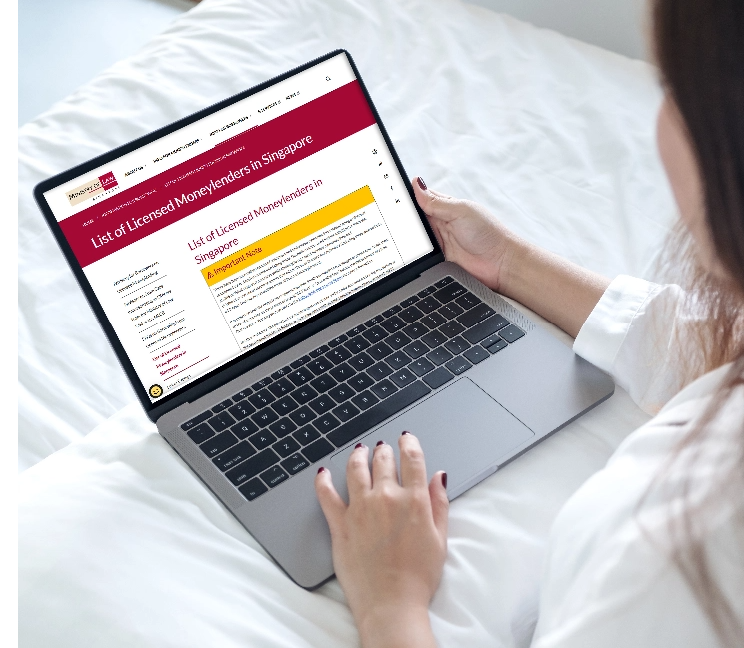

How can I identify licensed money lenders in Singapore?

An authorised money lender in Singapore is a registered loan company that conducts legal moneylending transactions with borrowers. It is approved, licensed, and regulated by the Ministry of Law.

To check whether a private money lender in Singapore is licensed, all you have to do is access the Ministry of Law’s list of licensed money lenders in Singapore. The list is periodically updated to show which local money lenders are in operation, as well as the ones that have been suspended.

What are R2D Credit’s qualifications and certifications?

As a licensed money lender in Yishun, R2D places an extraordinary focus on having the most qualified and most professional staff. Our experienced money lender team includes professionals with PhD qualifications.

We are a registered money lender that’s an accredited member of Credit Association of Singapore (CAS). We have earned the organisation’s certifications in PMFT (Prevention of Money Laundering and Financing of Terrorism) and Money Lender Operations & Compliance Training.

Additionally, our loan company is made up of a friendly and professional team with an incredible amount of collective experience. We have come out stronger and better prepared from the COVID-19 pandemic, and are one of the highest-rated money lenders in Singapore.

What types of loans do legal money lenders offer?

Different legal money lenders may offer different types of loans, but you can expect to access common ones such as personal loans, payday loans, business loans, medical loans, wedding loans, and long term loans.

Why do people borrow from licensed money lenders in Singapore?

Licensed money lenders in Singapore are extremely inclusive and accessible; it’s easy to qualify for their legal money lender loans so long as you’re of legal age and have a consistent income source. Plus, loan processing, approval and disbursement are pretty quick, too.

Here are a few other perks of borrowing from licensed money lenders:

A simple application process for your money lender loan

Minimal documents required

Get up to six times your monthly income for your money lender loan

Can I get a money lender loan despite having a bad credit score?

Yes, you can get a money lender loan even if you have a bad credit score. Legal money lenders in Singapore are happy to provide you with suitable financial solutions matched to your needs, and ability to repay. Here’s how to improve your credit score and boost your loan approval chances over time.

I’m a foreigner. Can I get a money lender loan?

Yes, foreigners can get a money lender loan as long as you’re gainfully employed, have a valid Work Pass, and can furnish all required documents. We do not discriminate against foreigners.

Do licensed money lenders offer fully customised loans?

Of course, licensed money lenders in Singapore are synonymous with providing customised loan packages for borrowers. This means everything from interest rates, payment due dates, to loan tenure can be negotiated and discussed freely before you commit to the loan!

Are licensed money lenders’ loans legally binding?

Yes, licensed money lenders’ loans are legally binding. Once acknowledged and signed, the lender and borrower must adhere to the terms and conditions as agreed upon in the loan agreement. For example, your money lender can charge you late interest and late repayment fees if you were to make a repayment past your due date.

Are all licensed money lenders the same?

Even though all licensed money lenders are authorised to provide moneylending services, their loan packages, terms and conditions, experience, customer reviews, etc. can vary. It is best to do thorough research before settling on the best money lender that can cater to your needs.

What are the interest rates charged by legal money lenders?

For the most part, money lenders’ interest rates range between 1% and 4% per month for their loans. The exact interest rate extended to you depends on a variety of factors. Feel free to contact us to learn more.

Do legal money lenders have fees and charges for their loans?

Of course. Money lender loans come with processing fees that can go up to 10% of the principal loan sum. At R2D Credit, our processing fees typically range between 8% and 10%.

Can licensed money lenders in Singapore charge hidden fees?

No. It is not legal for licensed money lenders to sneak in hidden fees and charges. Be sure to scrutinise your loan contract carefully just to be on the safe side!

Do licensed money lenders penalise borrowers for making early repayments?

If your circumstances and cash flow allow, definitely try to pay down your debt sooner rather than later. There are no early repayment charges that you need to worry about!

Do licensed money lenders penalise borrowers for making late repayments?

Yes, late repayments will cause late interest charges and late repayment charges to kick in. However, licensed money lenders have stringent caps to follow for such charges:

Late interest of not more than 4% monthly on the overdue sum

Late repayment penalty charge of not more than $60

Do licensed money lenders have rules to follow?

Governed by the Moneylenders Act, there are strict rules and regulations that registered money lenders have to abide by at all times. Case in point, money lenders are not allowed to overcharge borrowers or use scare tactics when collecting debt. Errant money lenders will be dealt with appropriately.

Do all licensed money lenders offer online loan applications?

While not all licensed money lenders in Singapore offer the convenience of online loan applications, R2D Credit does. You can even utilise Singpass Myinfo to fill out your application form with tip-top accuracy.

Can licensed money lenders in Singapore disburse loans remotely?

Absolutely not! Legitimate money lenders in Singapore cannot disburse loans remotely. Be wary if a lender tries to push for remote loan payouts.

Is it compulsory to meet up with my money lender?

Yes, it is compulsory that you meet up with your licensed money lender at their registered business premises. Your lender will have to verify your identity, do a simple credit assessment, and explain all loan terms and conditions to you clearly.

Is your money lender office open on public holidays?

No, our money lender office is not open for business on public holidays and Sundays. Feel free to drop by any time from 11.30am onwards on Mondays – Saturdays. We are open until 7.30pm on weekdays, and 6pm on Saturdays.

What can private licensed money lenders in Singapore do?

The following is a set of activities that licensed money lenders may engage in:

Advertise their money lender loans, but not wherever they want

Charge an interest rate of up to 4% per month

Charge late fees and administrative fees (capped)

Offer loans to borrowers with a steady income

Offer borrowers flexible repayment schedules

What can’t private licensed money lenders in Singapore do?

After having identified what legitimate money lenders are allowed to do in the above FAQ, take a look at what authorised money lenders can’t do:

Solicit loans through messages or cold calls

Perform loan transactions entirely online

Skip contract explanations and financial assessments

Keep your NRIC or any other personal ID documents

Withhold a receipt each time you repay your loan from the money lender

What are the benefits I can get when borrowing from a licensed money lender if I have a good credit history and/or am a regular customer?

We understand that repayment can be difficult when you’re borrowing from a licensed money lender. That’s why we reward clients who fulfil their responsibilities faithfully. They can expect a range of perks* that may include:

Loan principal amount

The eligibility to borrow larger sums of money for your money lender loan

Loan term

A longer repayment term

Interest rates

Lower interest rates, including prorated interest for early settlement

Fees

Lower processing fees for all money lender loans you take up

Late charges

A grace period to avoid late charges

Processing time

Accelerated money lender loan approval process, including instant approval. This includes a priority queue system for regular customers

Due date

The freedom to choose from the most convenient instalment due date

Payment reminders

Never miss a payment with our instalment due date reminders

Convenient hours

We extend opening hours at our authorised money lender office for your convenience

Special offers

Payday loans at 0% interest

Free documentation

A complimentary Statement of Account (SOA) for your loan

Personalised service

A dedicated loan specialist, so you enjoy a single point of contact. Regular customers in deep debt can receive a customised loan scheme and financial advice on debt management

*T&Cs apply

What is your eligibility criteria for money lender loans?

Borrowers of our money lender loans must satisfy the following criteria not only when applying with us, but when borrowing from licensed money lenders in general:

Be 18 years or older

Be currently employed

Earn a stable income

Furnish proper identity documents (NRIC, valid Work Pass)

Provide the relevant financial information (CPF contribution statements, payslips, and IRAS NOA)

Licensed money lenders vs banks: Which is the better option?

When choosing whom to borrow money from, there are some key differences you need to know about licensed money lenders and banks. Here’s a quick comparison between borrowing from banks and legal fast money lenders, assuming you are getting a personal loan:

|

|

BANKS |

LICENSED MONEY LENDER |

|---|---|---|

| Max. sum you can borrow | Up to 10x monthly income | Up to 6x monthly income |

| Max. repayment period | Up to 7 years | Up to 12 months |

| Loan approval duration | Up to 2 weeks (for new customer) | Same day, typically within 30 minutes of face-to-face verification |

| Typical interest rate | 3.5 – 6% per annum | 1 – 4% per month |

| Ease of loan approval | Stringent | Lenient |

| Processing fee | Typically 1% of the approved loan amount, some charge no processing fee | Up to 10% of the approved loan amount |

| Application procedure | Apply online or visit the branch office | Apply online or visit the lender’s office, but identity verification before loan approval has to be done in-person. |

24-hour money lenders in Singapore: Do they exist?

There aren’t any 24-hour money lenders in Singapore that are licensed. Those that run 24/7 and market themselves as ‘24-hour quick money lenders’ are likely to be illegal.

Although licensed private money lenders in Singapore have websites that run 24/7 (i.e. you can submit your loan application on the licensed money lender’s website anytime and anywhere to get a loan from the money lender), their physical offices have fixed office hours and do not operate round the clock.

How can I determine which licensed money lender is the best one for me?

Here are some characteristics that define the “best” money lenders in Singapore to help you decide:

The private money lender is licensed and has the relevant qualifications

The local money lender has a good variety of loans to meet your needs

The authorised money lender has a fast application and approval process

The money lender offers quick loan disbursements

The legal loan company offers competitive interest rates and charges

The firm has a credible reputation

The licensed money lender has verified reviews on Google and other websites

Negotiation is possible for a loan repayment schedule that works for you

Patient and knowledgeable loan officers who go the extra mile to ensure you fully understand all loan terms

The registered money lender has a convenient office location

What happens if I’m unable to pay a legal money lender?

If you don’t repay your money lender loan on time, expect to incur late fees, late interest, and compound interest on the amount that’s repaid late. If your loan is a secured one, your pledged collateral may be at risk of being liquidated.

Should you find yourself in such a situation, try to request a realistic payment extension — work things out amicably with your licensed money lender as many are usually willing to negotiate reasonably.

Is my personal information secure when I get a legal money lender loan from R2D Credit?

Of course, we pride ourselves on safeguarding your privacy at every stage of your loan journey with us. Your personal information will always be kept confidential.